Paysafecard Review – The Universal E-payment Method for Sports Betting

Paysafecard is a company that provides pre-paid vouchers which users can buy and use to make payments online. Initially, the business was established in Vienna in the year of 2000, as a stock corporation (then named Paysafecard Wertkarten GmbH), and since then has gone through a variety of infrastructural changes. Today, Paysafecard continues to be one of the most preferred brands when it comes to making purchases online or depositing funds into sportsbook accounts.

The Main Service of the Company and What You Need to Know About It

The first and most popular service offered to clients everywhere, is the prepaid electronic voucher. When a money amount is chosen, the seller issues a unique 16-number PIN that will contain the monetary value it was bought for. If a shop or a sportsbook accepts Paysafecard as a viable payment option, customers will be able to use the unique PIN number to make any sort of purchase online.

Available Paysafecard Amounts

You can buy an eMoney voucher in the following amounts: £10, £25, £50, £75, £100. Should you have access to a PayPoint shop, you will be able to purchase sums of £125, £150, and £175. You can visit a land-based sales outlet to get your voucher or acquire it online through websites that offer the Paysafecard product. You can find a Paysafecard voucher shop in more than 46 countries, which offer the service in their local currency. While the limits of the voucher aren’t that large in value, they are still more than efficient when it comes to online shopping.

Additional Conditions

If the available funds in your Paysafecard PIN are not completely used in 12 months, the remaining balance will be charged 3GBP per month after the 13th month. It is not uncommon to spend only a portion of your Paysafecard funds, while saving some for later any remaining balance after making a payment will be available for future use. To our understanding, the maintenance fee is there to promote a full use of the voucher itself, as well as cover additional service expenses.

Best Paysafecard Betting Websites

| Bookie | Review | Highlights | Cash Out | Bonus | Visit |

|---|---|---|---|---|---|

Sportsbet.io |

|

|

Weekly bonus: up to 100,000 USDT |

CLAIM BONUS

T&C’s apply, 18+.

|

|

| T&C’s apply | |||||

MyBookie |

|

|

Welcome Bonus: up to $1000 |

CLAIM BONUS

T&C’s apply, 18+.

|

|

| T&C’s apply | |||||

Xbet |

|

|

Welcome Bonus: 50% up to $500 |

CLAIM BONUS

T&C’s apply, 18+.

|

|

| T&C’s apply | |||||

BUSR |

|

|

Welcome Bonus: 100% up to $2500 |

CLAIM BONUS

T&C’s apply, 18+.

|

|

| T&C’s apply | |||||

The Charges and Fees when Using a Voucher

While it is officially stated that using a prepaid voucher is practically free, there will be some general fees that may apply. The first one is a currency conversion charge, if you have bought your Paysafecard PIN in one currency and you’re trying to pay in another, there will be a minimum transaction fee, which will depend on the type of currencies. The company’s official website features a conversion calculator that shows the percentage of the taxed amount between two currencies.

A “redemption fee” is charged when a client wishes to initiate a refund. The cost of the refund service is £6, and it is automatically deducted from the refunded amount it also applies to each refund. When compared to the available voucher amounts, the redemption fee does seem a little bit high however, the company does need to cover the expense of a return-transfer. You may check fees online – here.

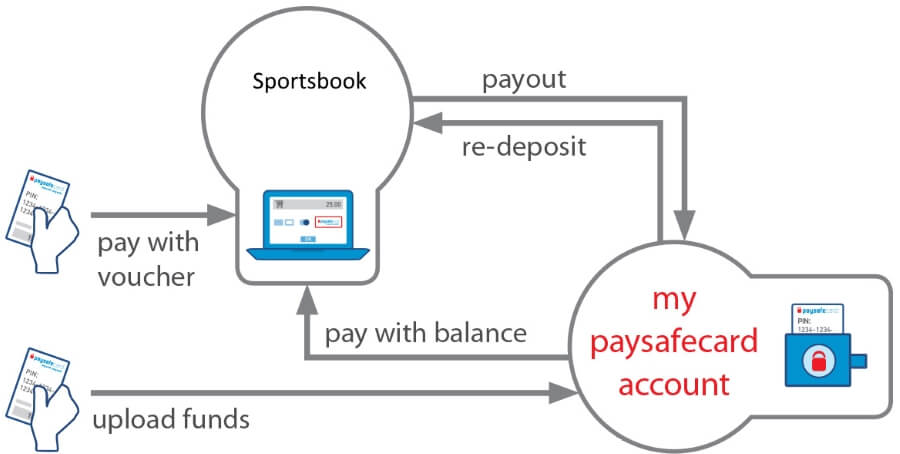

My Paysafecard – Login to Your Account

The other service provided by the company is called “My Paysafecard” and it is essentially an account in the e-wallet platform. Everyone can register for free and gain the ability to withdraw any winnings from sportsbooks and online casinos or receive funds from other sources. The registration process isn’t complicated, and it wouldn’t take a lot of time, but the verification process might take a bit more time. Here is a depiction of how a withdrawal process would work.

Although the terms and conditions are the same for all countries providing Paysafecard services, there might be a few differences. The last stage of account verification requires that the customer brings a personal document to a company-authorized outlet where they can confirm their identity. Upon final verification, the client will have access to the complete features of the platform.

Some Drawbacks May Apply

While the Paysafecard voucher service is indeed convenient for performing a swift and secure deposit, you will not be able to use it for any withdrawals. This might be perceived as a negative point by some, but it is to be expected since the prepaid vouchers work on a one-way-payment system. Punters and online gamblers don’t need to despair Paysafecard does provide a way for players to withdraw their winnings.

Sportsbook and Online Casino Bonuses May Await You

While there isn’t any indication in the official website that they offer bonuses and promotions, Paysafecard does feature the brands of a few popular British bookies and online casinos. Usually if a sportsbook would offer some type of bonus when using this particular method for depositing funds, it would come in the form of a free bet, which would be subjected to the terms and conditions of the venue itself.

The Prepaid MasterCard

Once your “My Paysafecard account” is up and running, you will be eligible to receive a free MasterCard. This is ideal for punters and gamblers, because after collecting their winning from their gaming accounts, they will be able to withdraw their money from any ATM that accepts MasterCard. The card itself falls into two categories, everyone of each has its own functionality limits, which are depicted below.

Maintenance of your MasterCard will have some fees, but they are not that high. The yearly cost of owning it will be £8, with a charge of 3% (or a minimum of £3) for any ATM withdrawals. Foreign currency payment will be 2% of the sum paid, and the standard top-up fee is going to come at 4%. Your MasterCard will not be connected to your bank account, so you won’t have to worry about compromising any funds.

The Paysafecard App Is Very Useful

Using GPS to find stores that sell pre-paid vouchers, top-up PINs, balance checks, promotions – these are only a few of the numerous benefits the company offers through its mobile application. It also supports wearable technology, so you can use your Apple Watch or Google Wear for maximum convenience. Should you’ve chosen to make a “My Paysafecard” account, you will also have access to the functions provided by the online platform as well.

Final Words

Paysafecard is more than useful when it comes to recharging your sportsbook or online casino account, especially if you’re looking for safety and anonymity. Lower amounts won’t allow you to make a mistake when making a deposit and the efficient customer support line will ensure that any inquiries you have are answered as quickly as possible. Some of the rates might seem a bit high, but it is understandable given the convenience of this e-money platform – try it out for yourself, and maybe you will like it.